Why Do People Find It Difficult to Pay Their Bills?

People across income levels struggle to pay their bills on time. In many cases, it leads to a financial crisis for households. A lack of financial support is one of the key reasons behind such struggles.

Economic recessions and joblessness are two prime causes why people can’t afford to pay their bills. However, many people find it hard to pay their bills even if they make a good income. It is pertinent to note that households with all income levels struggle with their bills. For many, it is caused by a lack of financial management skills. However, for most households, the lack of financial resources remains the key hurdle.

Why Do People Find It Difficult to Pay Their Bills?

Let us dig deeper to reveal what are the actual causes that hinder people from paying bills on time. Economic recessions, falling income, and joblessness are broader reasons that affect everyone.

Low Earnings

Many people do not earn good enough to make a comfortable living. They live from paycheck to paycheck. Thus, making it difficult to pay bills as they always find it hard to manage their finances due to low earnings.

Not Living Within the Means

Unsurprisingly, even if many people come with low earnings, they spend more than they earn. Thus, people not living within the means would always find themselves chasing bills and credit card payables.

Using High-Interest Credit Cards

When people come short of money, they turn to credit cards. Unfortunately, credit cards come with high-interest rates. The credit card bills keep up piling that keep you tied in the vicious circle of unending debt.

Not Saving for an Emergency Fund

Emergencies occur at unwanted times and to everyone. Many people do not prepare themselves well and never set aside an emergency fund. As a result, once they go short with money due to an emergency, they find themselves behind on due dates of bills.

Lack of Community Financial Services

It is hard to find community-based financial services that can help you pay bills regularly. You can find one-time support from many organizations but not regularly for paying bills. (Well, not anymore with Scrapabill).

How to Manage your Bills?

Like many others, we can teach you tons of personal finance tools. But let’s spare you from the financial jargon for now. Personal finance tools require building life-long habits. We encourage everyone to develop such skills.

Scrapabill is another way to help you pay the bills that you otherwise can’t. Unlike other crowdfunding sites, you get recurring support when you support others. Learn more about our services Here.

Managing your Bills with Scrapabill – How it is a Revolutionary Idea for many People?

What if you have a bill payment due date coming up? Even worse, you’ve already consumed the credit card limit? You'll surely let the due date lapse and pay it with a penalty later. Scrapabill was launched with the idea of helping people with paying their bills. It's a platform where you can support others, get support, and build a network of your followers and bill supporters. Here are a few basics to get things going with Scrapabill.

Support Others and Get Supported

Scrapabill is an online community where you support others to pay bills and get supported in turn. We have created a platform where people can share their bills and support each other. You can support a bill by funding with as low as $20 and help the applicant until it gets scrapped.

Growing your Network on Scrapabill

Spread the word to support more people. Bring more people from your friends and family circle to join our revolutionary platform. Growing a network at scrapabill will eventually benefit you and everyone around you.

Get Free Money to pay bills with Scrapabill

As you support others with as low as $20, you can post a request to get financial support by entering your bills one after the other. You'll get support from your fellows in the network and everyone else on Scrapabill. You can keep your bill posted until it is fully financed and scrapped.

Final Thoughts

Financial hardships and low earnings are key hurdles that keep people from paying their bills. Finding alternative financial sources has become easier with Scrapabill. You can support others and get supported with your bills easily through an outstanding digital community of givers.

What are you waiting for? To register and create your account at Scrapabill, click Here.

How Scrapabill Can Help African People with Their Financial Problems?

Global economic recessions affect every community in the world. Developing nations find it even harder to cope with such financial challenges. It becomes a survival challenge for many to stay afloat in such circumstances. People look for alternative credit solutions. In reality, debt financing becomes unavailable to many as their income levels deflate and credit scores take a dip. Scrapabill is an idea to offer alternative credit to people globally.

Financial Problems in African and Developing Nations

From financial literacy to the lack of financial resources, there are several challenges that people in Africa and other developing nations face. Government entities and commercial banks offer assistance but that is hardly sufficient. Let us take a glance at the top financial challenges faced by these communities and see how Scrapabill can help them overcome these challenges.

Financial Literacy

Financial literacy does not mean a post-graduate degree in finance. It means to develop the understanding of basic financial concepts like credit score, interest rates, budgeting, savings, and investment basics at least. African and other developing communities fall behind the financial literacy. It hinders their financial progress in several ways.

Low Income

These communities earn a low income as compared to other developed communities. It means people living in developing countries will always fall behind their financial needs. Their formal and informal earnings resources are limited.

High Unemployment Rate

The high unemployment rate is one of the biggest reasons for low-income levels in these communities. These communities struggle with finding formal and informal earning methods.

Expensive Credit Facilities

As a result of low earnings, these communities cannot develop credit scores. Thus, commercial financing becomes expensive. Commercial banks and creditors charge high interest rates as compensation for risky debt financing.

Lack of Alternative Financing

One way of overcoming financial challenges is through alternative financing options. However, we can see visibly low participation of community-level crowdfunding and alternative financial support in African communities.

Struggle with Paying Bills

All of these financial challenges for African people mean they fall behind the comfort levels at any given time. They keep paying for high-interest rate debts. Yet, they find it difficult to fund their necessities such as paying for bills on time. Obtaining formal financial services is a global challenge. The challenge becomes sterner in African communities and developing nations for various reasons. Such financial problems escalate quickly in economic recessions such as the current one due to COVID-19. Financially struggling people turn towards debt financing. However, debt financing is seldom available to everyone or comes at a high cost of borrowing. Either way, it results in an unending circle of debt repayments one after another.

How Scrapabill can Help African People and Other Developing Nations?

We introduced Scrapabill with an idea of financing solutions to the challenges discussed earlier. One of the most common hurdles for many people is the lack of alternative financial resources. Scrapabill offers an effective and low-cost financial model that works at every level. It is a digital financial service, hence accessible from anywhere in the world. African communities can take advantage of easy access to our global platform.

Paying Bills through Scrapabill

All you have to do is to sign up with Scrapabill. You'll create a profile and post an application to receive cash support. You can spread the word by asking your friends and family to join the cause. Every participant can contribute towards bill payment with a minimum of $20. You can keep the post until your bill fully gets “Scrapped.” With Scrapabill, you do not need to run after commercial loans with a mind-boggling documentation process. You'll be spared the high interest rate and servicing costs as well.

Growing your Network

At Scrapabill, you follow a community of sincerely connected people that are interested in helping each other financially. Unlike other social networks, Scrapabill lets you follow and support bills. You follow and support others with a minimum contribution of only $20. In return, you get financial support for paying bills when in need.

Final Thoughts

Scrapabill can help African communities as an alternative financing solution. As it’s a fully digital financial network, people can access it easily. Paying bills and supporting others has never been easier than with Scrapabill.

To register and create your account on Scrapabill, click Here.

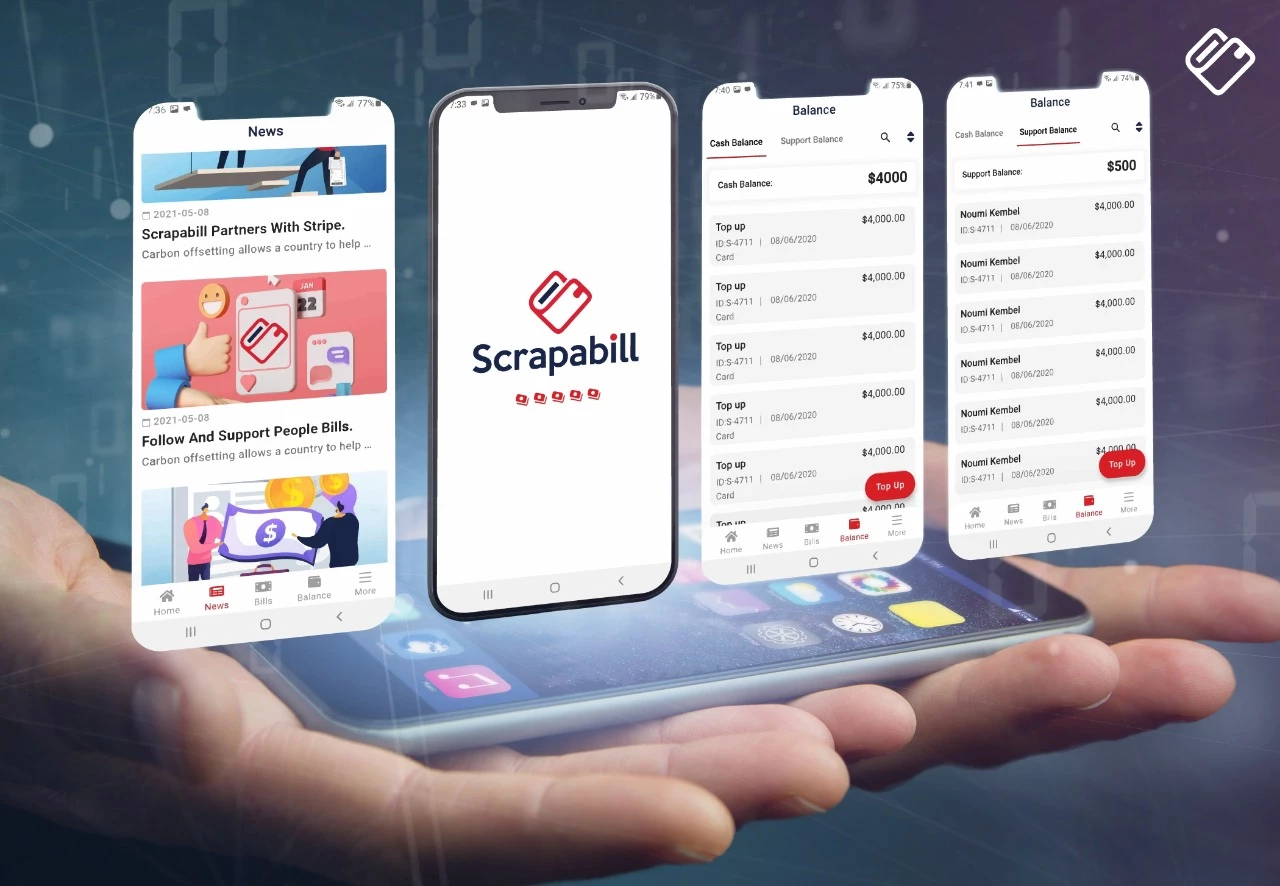

Scrapabill Developers Is Developing Its Modern Mobile App

We are excited to announce that Scrapabill developers are developing our first Mobile App for our website scrapabill.com! We've been working on the design over the past few months and now have a tentative release date for early fall 2021. In this blog post, we will share some more details about what's in store for you in the next version of Scrapabill.

But first, let see what we have been working on

From the beginning, Scrapabill was only available in the form of a Web Application. But since everyone is leaning towards smartphones more and more, causing the web browser to become insignificant for many users. We have been thinking about that, and now we're working hard on making Scrapabill available on mobile devices. It will be available on both Android and iOS.

What is Scrapabill?

Scrapabill is a social networking platform that helps you get cash support to pay your bills and manage your money from the comfort of your home. It enables you to enter and post them (bills) one after the other and helps you record your expenses. You can check and track your cash and support balance, tell financial stories to let friends and family members connect directly with your bills and money support account. We believe that today's users have more power than ever before over their financial well-being. They don't need to borrow money unnecessarily and can manage it better for going forward. With Scrapabill, you have a place to not only track all cash support to pay bills and manage your spending today – but also plan your expenditure.

Scrapabill also allows you to connect with your family and friends. You can share your goals and discuss how to set them up in a way that works for you. You can also collaborate with your loved ones to see who is paying their bills, so there are no more late fees from friends or family members. You can help each other pay off loans, credit cards, car payments, and all kinds of debt you may be carrying. There are many possibilities that Scrapabill can provide to the community by connecting family and friends together.

What's in the Scrapabill Mobile App?

The Mobile App will bring many of the same great features available on the Web application at Scrapabill.com, with some exciting new additions. We'll be able to add more frequently asked-for features that were not possible in the website-only version. For example, users will be able to Scrap bills quickly while on the road and take snapshots to get fast cash support.

We'll have a section on the Mobile App where you can check when the posted bill is due and view your cash top-up, and support payment history.

We'll also feature a section on the Mobile App where you can set financial goals, receive notifications from friends and families. You will be able to outline the total amount of bills you would like to scrap every month.

And if you are worried about privacy issues, don't worry! All your data will be 100% private – it will never get shared anywhere on the internet (you can also set your goals as secret if you want to keep them confidential from anyone else).

We'll also build in a new section where you can view the status of any payments or transfers. This way, you'll always be able to confirm that your friends and family members have received the money you've sent!

What's Next?

Our goal is to have the Mobile App out as soon as possible. We'll continue to post updates on our blog and social media pages with more details about the Mobile App's upcoming features. For now, sit back and enjoy the Web Application at Scrapabill.com – knowing that you'll soon have the power to pay your bills and manage your money from anywhere you want!

Conclusion

We are excited to announce that we have been developing the Scrapabill Mobile App for all our users. It will be available soon at Google Play and Apple Store for downloads, and we are looking forward to sharing it with you all soon!

To register and create your account on Scrapabill, click Here.

Why Is It Good to Discuss Financial Problems?

For many people, discussing money issues with family and friends could be intimidating and uncomfortable. This is due to the risk of being wrongly judged or scrutinized. Furthermore, these individuals keep their financial situation hidden and refuse to share their monetary problems in an attempt to feel secure and away from blame.

A recent study at a psychiatric institution in the States showed that people retract from talking about money because of the lack of trust towards their community and the misbelief that not having enough money is associated with the lack of power.

Women Who Money wrote a blog post lately discussing this topic and concluded that opening conversations about money problems, relieves stress and brings us closer to finding solutions.

So Why Do We Avoid Talking About Money Problems?

Money is more than just a bill or a document of ownership. It is the piling personal beliefs, values, and goals that people contrast against their existence. From early childhood, humans grasp the importance of money and create a sense of vulnerability towards it.

On the other hand, shame and guilt are experienced when a person fails to possess the financial means to get what they want or buy the things they love. I am a bad person or I did something wrong, that is why I lack money! These are the moral comprehensions of people in need, as Brene Brown puts it.

The fear that our financial problems might badly affect our relationships, is another aspect that catches our attention. Our family and friends could become adverse and prefer to distance themselves from us.

Another factor is the stress from being seen as unsuccessful. A common belief in our culture. People who make money are recognized as achievers and capable individuals.

These misconceptions and emotional distractions are the elementary reasons why we refuse to discuss financial troubles.

How Does It Help To Discuss Our Money Problems?

Firstly, discussing your financial issues shows your partner that you care about them and that you are willing and trying to solve your problem through discussion and honest conversations. Otherwise, and if they find out on their own, they will feel cheated and deceived.

Next, people sense that you are under stress and they might get confused or misinterpret your behavior with someone aggressive or hateful.

It should also be clear to you that you are not alone. People from all walks of life face these types of problems and they could be a great source of inspiration and guidance for your good sake.

Again, sharing your money problems relieves stress and can be the key to getting support from caring individuals. The more you talk about your problem, the less emotional it gets.

You should also recognize that money does not reduce or define you. People are not only what they own or possess. They are the conglomerate of emotions, thoughts, and personalities. This is the value and importance of being a human being.

In a conclusion, get help by sharing your situation and help others by showing them how you overcame your obstacles and solved your financial problem. Also read and learn how and with whom to discuss or get guidance. Plus, signup for Scrapabill and share your story. You will be surprised how similar-minded people are supporting and sharing valuable information about your condition. Be confident and learn something new each day!

To register and create your account on Scrapabill, click Here.

Scrapabill Picked Stripe For Processing Cash Support Contributions

With the potential to process billions of dollars in transactions worldwide to help friends and families scrap their bills, Scrapabill has selected Stripe, one of the world's leading payment processors, to handle all its cash support transactions. By partnering with Stripe, we want Scrapabill users globally to know that their online payments will be highly secure and meets all GDPR and PCI compliant.

What you need to top-up your cash support balance

With Scrapabill and Stripe working together to help us achieve our corporate goals and objectives, giving and contributing cash to support a friend's bill, no matter where they live, has become much faster, easier, and secure. Apart from having integrity and the desire to support one another, you will need to have and do the following:

Have a valid major Debit/Credit card

Use a valid major debit/credit card to top up your cash balance. You will need to have at least USD 20 at all times in your account prepared to give cash support while entering and posting your bill.

Ensure your posted bills and ID are verifiable

Scrapabill wants to keep its platform safe from abuse and misuse, so we have strict compliance in our method of delivery of services. We implemented the Anti-Money Laundering and Know-Your-Customer regulatory policy in Canada, the United States, and worldwide to keep our platform friendly by identifying every user that benefits from scrapping their bills on Scrapabill. Stripe will assist us in meeting these regulatory standards and objectives.

Identify and recognize the people you want to follow and give your support

Scrapabill encourages you to give support and at the same time expect to receive from others. We currently live in a social media world where people are focused on following and emulating the lifestyles of others. Follow bills and give support after completing your top-up. Read financial stories, and if the story touches you, proceed to following and supporting the bill.

Conclusion

With Scrapabill and Stripe working together, processing all cash support and other transactions should enable us to achieve our goals and make the world a better place to live. Many of our users will feel much happier knowing that someone cares about them and helping them to get ahead in this challenging financial world we live in today.

To register and create your account on Scrapabill, click Here.

What Does Follow And Support A Bill Mean On Scrapabill?

We are currently in a digital world where everything we do now is digital and done online. The world of social media and social networks has taken over our lives. People are now comfortable doing almost everything online, such as shopping, watching movies, playing games, training, online education, delivery, meeting strangers, making payments, paying bills, and the list goes on and on. Many have closed business deals and investments worth millions of dollars online. But then, we are busy following people and admiring each other lifestyles, and sometimes we criticize the things that people do online.

Follow Bills Instead of People Lifestyles

Today, Scrapabill is a unique social network that allows people to follow bills instead of the lifestyle and the things that people do online. It enables you to follow friends or family members' bills struggling or needs cash support in making a bill or debt payment before it goes to collection. The first step to understanding how to follow and give cash support on the platform is to have the right mindset and understand the benefits of joining Scrapabill, how to follow and support bills.

Give Cash Support to Receive

Some people are reluctant to follow others, top-up, and give cash support. They may think they are doing the receiver a favour. The Scrapabill social network gives you more than what you have contributed towards scrapping the bill of a friend, neighbor, brother, or sister and those within the community or area you live.

Paying Bills is a Part of Life so Take The First Step to Follow a Bill

The Scrapabill social network operates on the principles and the shared value of giving and receiving. Since bills are part of our day-to-day life, they never stop coming because, as adults, we have financial responsibilities. Following a bill doesn't mean you have to support it. However, it is the first step. The system allows you to follow the active bill of a friend or family member you find or notice on the platform.

Become a Bill Supporter to Establish Your Network

One of the signs of an active bill is the fact that it is in process. The scrap goal is the total cash support amount needed before it gets pulled off from the platform. Once you have followed the bill, you must top-up with just $20, given to the bill owner. You become a bill supporter after it eventually gets scraps from the platform. As a bill supporter to a friend, you get rewarded with the opportunity of entering your bill so you can establish your bill support network globally.

Following and Supporting Bills On Scrapabill Will Never End

This process of following and supporting bills never ends. It becomes a perpetual circle of bill followers and supporters coming together to ease the financial burden of everyday life worldwide. It is nice to know that whenever you are stranded for cash or don't have enough to complete your rent, mortgage, phone bill, internet, subscriptions, daycare, school fees, or whatever obligations you have, you have the option to use Scrapabill and scrap the bill. Never ask a friend for a loan when you can come to Scrapabill to seek free cash support because rejection doesn't feel good when they refuse you.

Conclusion

When you follow a bill, it means that you are preparing to support it. When you give cash support, you contribute a small amount towards a friend, giving you the same opportunity to enter your bill and get cash support from someone else. It is a brilliant mutual cash supporting system that prevents the creditor from knocking on your door, borrowing money from friends and relatives, and taking unnecessary loans.

To register and create your account on Scrapabill, click Here.

If I Can't Pay Off My Debts, What Options Do I Have?

Whether you've taken on too much debt or have experienced a sudden decline in income, there may come a time when you simply don't have the cash you need to send to your creditors.

This financial downturn could happen almost to anyone; especially during the COVID-19 pandemic. Because many of us might have lost our jobs, are working fewer hours, or have increased health and medical expenses.

The important thing is to act quickly and not let this problem escalate!

Firstly, you should evaluate what type of debt you owe creditors. There are secured debts like mortgage and car loans that allow creditors to collect from a property and other assets you pledged as collateral. Unsecured debt mostly credit cards requires the creditor to file a lawsuit against you and get a judgment. Government debts like taxes, domestic support, and student loans are also unsecured but allow for special collection rights.

Deciding on the priority of debts is another critical factor that helps you plan how to start scrapping these debts and which ones to pay first.

High priority debts

Mortgage, child support, utility bills, car payments, student loans, and unpaid taxes require immediate action and must not be delayed.

Medium priority debts

Insurance, credit cards, and court judgments could be rearranged or postponed by maintaining a good relationship with the creditor.

Low priority debts

Department store and gasoline charges and loans from friends and relatives could stay unpaid or delayed for a longer period. According to The Ascent, there are short-term and long-term actions you can take to alleviate the consequences of not being able to pay your debts.

1. Do nothing

You can take this course of action if you are sure that your creditors can’t collect from you even if they get a judgment against you. These apply when your situation is permanent, your debt is unsecured, your property is protected by an exemption and your income can’t be garnished.

2. Negotiate with creditors

By negotiating directly with your creditors your debt could get some relief. For example, you could reduce or temporarily suspend mortgage payments with a forbearance or loan modification. You could also lower your credit card payments or interest rate by reaching an agreement with your lender.

3. File for bankruptcy

If you are unable to reach an agreement with your lender and things get impractical. You could ask the court to eliminate the debts you owe or file a plan on how will you repay your debts.

4. Stay away from tricks and scams

When you are in a bad financial situation, you could be vulnerable to scammers, collection tricks, and bad options. Make sure you consider your debt relief plans wisely.

Consult with a lawyer

Lawyers are well educated and informed about how to help you with your debt relief plans. So, consider contacting a debt relief lawyer or a bankruptcy attorney.

Sign up for Scrapabill

Scrapabill is a social networking platform that allows you to connect with family and friends, share your financial situation, and ask for bill support. It is a means to get money from your followers and pay your debts; without the need to go into uncomfortable procedures.

Conclusion

Debts could be exhausting and difficult to overcome. Leaving you confused and frustrated about the consequences and course they may take. Therefore, you need to be open-minded and clever enough to deal with them adequately. From all the options we presented, Scrapabill could be a very practical and friendly way to manage and get financial support; that could save you the trouble of going into unnecessary debt hardship. Try it today and start scrapping your bills and debts.

To register and create your account on Scrapabill, click Here.

How I Got Free Money On Scrapabill To Pay My Bills

No matter how organized we may be in trying to keep expenses and payments within budget, some unexpected and emergency bills may come up and put us in an undesired condition. And if we search for advise on the internet, we might get some common ideas like prioritizing bills and delaying least important payments. Negotiating debt and doing side hustles. These are surely practical things we can try. But what if, they are not enough and collectors are knocking at our door to get their credit paid?

Before answering these questions, I would like to accentuate what could happen if we don’t pay certain bills.

If we don’t pay a loan, we might receive a bad reputation on our credit report. The creditor might take possession of whatever collateral we legally promised against the debt. We might also put a risk on the credit report of the person who cosigned the loan with us.

If we don’t pay our medical bills, we will start getting calls and letters and then the collectors might sue us in effort to garnish wages or put a lien on our property.

If we don’t pay our student loan, we might lose access to loan forgiveness, payment plans and financial aid. And if the loan is sold to a collection agency, the same with medical bills would happen and they might even take our tax refunds.

If we don’t pay our car payments, and we are upside down on the car; meaning we owe more than the car can be sold at. We might need to get another loan and we are back in the same cycle of mess.

If we don’t pay our taxes, we might end up in jail for tax evasion, not filing tax returns or assisting someone to evade taxes.

If we don’t pay our credit card debt, we might incur late fees and penalties, get a lower credit score, increased interest rate on all cards and possible legal action.

The list continues with child support, utility bills and so on…

And as you can see that bills never end and are recurring every month; nonstop!

So, by now you are wondering what is this magic solution, and how I got help pay my bills free?

In Vancouver, British Columbia, Canada, a team of young entrepreneurs became aware of this problem. Living the same struggles in paying their bills; like everyone else. They created a networking platform where people in need of support can post bills, share financial stories and ask for help. Scrapabill.com is a place for honest and confident users who are not shy of asking for help and are also generous to provide help to other members on the platform.

Then, how does it work?

Each user must post a bill on the platform before he/she can start using the platform. Hence, all members are equal and share a similar moral about support.

Members can socially and proudly invite other members to join their bill support network.

The First 100 Users get $10 grant or upfront support from Scrapabill.com team.

The service is global! Therefore, members on the platform come from all nations and ethnicities and there is no discrimination or prejudice about this community.

Scrapabill.com has appointed a Data Protection Officer to comply with GDPR and CCPA and other international privacy laws.

It currently uses Stripe payment gateway to keep all cash support contributions and payout secure. So from now on, you don’t need to borrow money to pay your bills! Just write your financial story and post a bill on Scrapabill.com, send invites to friends, family and members then your bill will start getting contributions and gets scrapped.

Confidently say; I’m disabled and can’t pay my bills. I need help with paying electric bill. I need help paying utility bill. Please pay my electric bill or please pay my utility bill because I have this and that problem… Nothing to be worried or reserved about because everybody needs help at some point in their lives and giving back to society and friends is a gesture that is praised and appreciated.

Finally, I would like to highlight 10 tips on how to overcome the fear of asking for help as it is described in Forbes by the Expert Panel, Forbes Coaches Council.

1. The first thing to think about is that asking for help is not an inconvenience for others; instead, it is a sign of respect. So prepare forehand on the story you want to share and believe that no one can do it on his own. Plus, once you prepare and understand the problem, you will be more comfortable to confidently ask for help.

2. Don’t consider that asking for help is a sign of weakness. However, it is a sign of strength and awareness. People who perceive the world in an extrovert and objective manner, comprehend the difficulties it bears and the importance of uniting with society members.

3. Learn from others how to ask for help. You can emulate the way other members formulate and ask the right questions, especially if you don’t see the inherent value in yourself. How someone we admire writes and convinces people to support him/her boosts self-trust and belief in our case.

4. Don’t wait until things go wrong unnecessarily. Try to build meaningful relationships with your following in order not to engage with them only when you need help. This way they feel more valued and respected; which leads to a high tendency to support you.

5. Give others the opportunity to contribute. People love and feel more fulfilled when they contribute. Because asking for help adds value to their gifts and desire to aid.

6. Remember that members are not obliged to help; they can make their own decisions so ask away.

7. Research your issue and share your learnings. People like you to add value to them and they will be happier to help you if they find that you have done your part.

8. Asking for help improves your self-esteem, shows that you have the ability to be productive and efficient. It helps you turn the fear of rejection into a belief that you have emotional maturity.

9. Focus on the end result. Your priority is to solve your financial problem. And when you don’t shrink on asking for help from others it opens the door for them to ask from you in the future. This improves the interpersonal relationship and promotes an environment of trust and appreciation.

10. Finally consider the possible outcome of not asking. You would surely be in a worse condition than you are now; knowing that you have messed up drastically. Therefore, build the courage and confidence in yourself and start your journey to become an honest and socially correct person by engaging in asking and giving away to others.

As a conclusion, Scrapabill has founded a new and exciting community for casual and open minded people to share their financial troubles and get precious solutions from others; in an attempt to make our world friendlier, more social and financially reliable.

To register and create your account on Scrapabill, click Here.